Car insurance is a vital aspect of the financial and economic landscape in any country, offering protection to vehicle owners in the event of accidents, theft, or other unforeseen incidents. However, in Nigeria, the car insurance industry faces significant challenges that hinder its growth and the attainment of its full potential. These issues range from a lack of adequate information about insurance to socioeconomic barriers such as the low standard of living. This article delves into the primary problems affecting car insurance in Nigeria and explores their root causes and implications.

Lack of Adequate Information

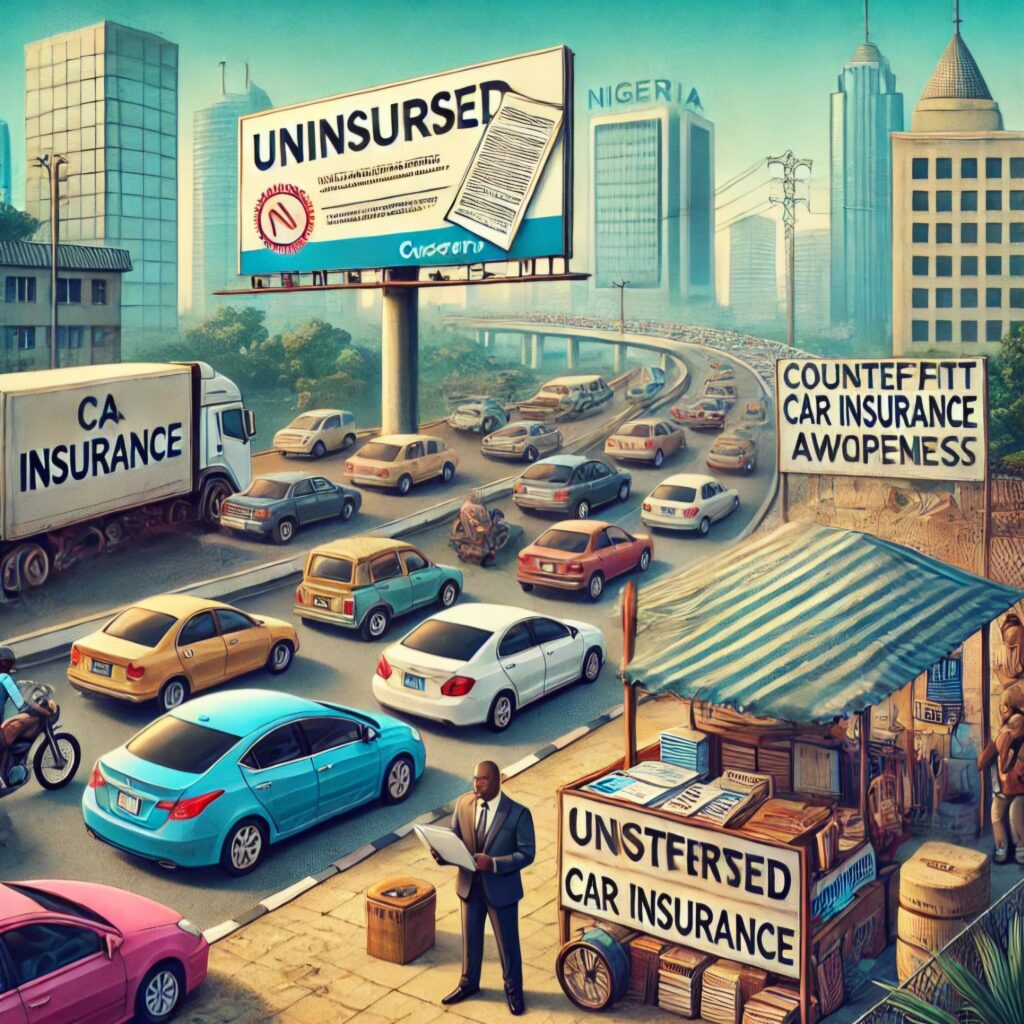

One of the most pressing challenges facing car insurance in Nigeria is the lack of adequate information. Many Nigerians are unaware of the different types of car insurance, their benefits, and how these policies work. Terms like third-party insurance, comprehensive insurance, and policy premiums are foreign to a significant portion of the population.

This lack of knowledge is exacerbated by limited efforts on the part of insurance companies to educate the public. In developed countries, insurance providers often invest heavily in awareness campaigns to ensure their audience understands the value of their products. Unfortunately, in Nigeria, these campaigns are minimal or nonexistent, leaving most people to rely on hearsay or incorrect information about car insurance. This situation creates an atmosphere of mistrust and skepticism, as potential clients fear falling victim to fraud or exploitation due to their ignorance.

Low Standard of Living

Nigeria’s socioeconomic reality presents another critical challenge. The country’s low standard of living means that many people struggle to afford even the most basic necessities, let alone additional expenses such as car insurance. Comprehensive insurance policies, which provide extensive coverage, are considered a luxury by many Nigerians who prioritize immediate needs such as food, shelter, and education.

The prevalence of poverty significantly reduces the uptake of car insurance, as most Nigerians cannot justify the cost. Even when people are aware of the benefits of comprehensive insurance, the economic hardship faced by the majority prevents them from making such an investment. This situation forces many to opt for cheaper, less effective third-party insurance or, worse, to drive uninsured altogether, exposing themselves to financial risks.

Lack of Awareness and Poor Knowledge of Insurance

Closely related to inadequate information is the general lack of awareness and understanding of the concept of insurance. Many Nigerians perceive insurance as a scam or unnecessary expenditure. This perception stems from cultural and historical factors, where the idea of paying for a service you might never use is considered wasteful.

The mistrust towards insurance companies also plays a significant role. In the past, there have been instances where claims were denied or delayed unjustly, further eroding public confidence in the system. As a result, even those who can afford insurance might choose to avoid it, viewing it as unreliable or untrustworthy.

The lack of proper regulatory enforcement compounds this problem. While it is mandatory for every car owner in Nigeria to have at least third-party insurance, this law is not effectively enforced. Many people either purchase fake insurance certificates or simply ignore the requirement altogether, leading to widespread noncompliance.

High Rates of Fraud and Fake Insurance Policies

Fraud is another significant issue plaguing the car insurance sector in Nigeria. The market is flooded with fake insurance agents and counterfeit policies, which further undermine public trust. Unsuspecting car owners often fall victim to these schemes, paying for policies that offer no real protection.

This proliferation of fake policies is partly due to weak regulatory oversight and the fragmented nature of the insurance industry in Nigeria. Without stringent monitoring and enforcement mechanisms, fraudsters can operate with impunity, tarnishing the reputation of legitimate insurance providers.

Poor Service Delivery

Even for those who manage to secure genuine car insurance policies, poor service delivery is a common complaint. Many policyholders have reported delays in processing claims, inadequate compensation, and cumbersome bureaucratic procedures. This inefficiency discourages people from investing in car insurance, as they feel the effort and cost are not worth the hassle.

Insurance companies in Nigeria often lack the technological infrastructure needed to streamline operations and improve customer service. In a world where digital solutions are revolutionizing industries, the Nigerian insurance sector remains largely manual and outdated, further alienating potential clients.

Cultural Barriers and Attitudes

Cultural beliefs and attitudes also play a significant role in shaping the car insurance landscape in Nigeria. Many Nigerians hold the view that accidents or losses are acts of fate or divine will, which cannot be mitigated by insurance. This mindset discourages people from seeing the value of insurance as a preventative measure.

Additionally, there is a lack of trust in the formal financial sector, with many Nigerians preferring informal systems of risk management, such as personal savings or community support. This cultural resistance to formal insurance mechanisms poses a significant challenge to the industry’s growth.

Addressing the Challenges

To address these issues, a multi-faceted approach is needed:

• Public Education Campaigns: Insurance companies, in collaboration with regulatory bodies, should invest in awareness campaigns to educate Nigerians about the benefits of car insurance. These campaigns could include advertisements, workshops, and community outreach programs tailored to different demographics.

• Affordability and Flexible Policies: Offering affordable and flexible insurance packages can help accommodate the financial constraints of low-income earners. Microinsurance products, which provide basic coverage at minimal cost, could be a viable solution.

• Stronger Regulation and Enforcement: The government must strengthen the enforcement of insurance laws and crack down on fraudulent activities in the sector. This effort would include implementing stringent penalties for offenders and ensuring that only licensed providers operate in the market.

• Improved Service Delivery: Insurance companies should adopt modern technology to streamline their operations and enhance customer experience. Faster claims processing, transparent policies, and accessible platforms can help rebuild trust among consumers.

• Cultural Sensitization: Efforts should be made to address cultural barriers through targeted campaigns that highlight the practical benefits of insurance. Collaborating with community leaders and influencers can help shift public perception.

Conclusion

The car insurance industry in Nigeria is plagued by numerous challenges, from inadequate information and low living standards to fraud and cultural resistance. However, these issues are not insurmountable. By addressing these challenges through education, regulatory reforms, and improved service delivery, the industry can build trust and expand its reach. Car insurance has the potential to provide financial security and stability to millions of Nigerians, but it requires a collective effort from stakeholders to unlock this potential.