In Nigeria, car insurance plays a significant role in ensuring that both vehicle owners and road users are protected from financial liabilities arising from accidents. By law, Third-Party Motor Insurance is the minimum insurance cover that every vehicle owner or user must have to legally operate on Nigerian roads. This article delves into the compulsory nature of car insurance in Nigeria, explains the distinctions between third-party and comprehensive insurance policies, and highlights the benefits of each type.

Legal Requirements for Car Insurance in Nigeria

The Federal Road Safety Commission (FRSC) and other road authorities mandate third-party motor insurance as a legal requirement for all vehicles plying Nigerian roads. This law aims to provide a basic safety net for victims of road accidents, ensuring that individuals affected by the actions of a negligent driver can be compensated for their losses.

When renewing vehicle papers at the Directorate of Road Traffic Services (DRTS), it is almost automatic that the third-party insurance is renewed alongside other vehicle documentation such as proof of ownership and roadworthiness certificates. Similarly, when registering a brand-new car, the process includes obtaining a third-party insurance policy as part of the documentation package.

What Does Third-Party Motor Insurance Cover?

Third-party motor insurance offers limited but essential protection. It covers:

• Bodily Injuries or Death: This policy compensates victims for injuries or fatalities caused by the insured vehicle.

• Property Damage: It covers damages to the property of third parties involved in an accident caused by the insured vehicle.

However, it is essential to note that third-party insurance does not provide any protection for the insured driver’s vehicle or their bodily injuries. This means that if you are involved in an accident where you are at fault, the costs of repairing your own vehicle or seeking medical treatment for your injuries will be your sole responsibility.

The Importance of Third-Party Motor Insurance

Third-party motor insurance is fundamental for road safety and legal compliance in Nigeria. Without it, vehicle owners face penalties, including fines, vehicle impoundment, or being barred from driving altogether. This policy ensures that innocent victims of road accidents are compensated for their losses, thereby reducing financial burdens on the victims and their families.

Comprehensive Motor Insurance: A Step Beyond

While third-party motor insurance is compulsory, comprehensive motor insurance is optional in Nigeria. However, many vehicle owners opt for comprehensive insurance due to its extensive coverage and added peace of mind.

What Does Comprehensive Insurance Cover?

Comprehensive motor insurance covers:

• Your Vehicle: Unlike third-party insurance, this policy covers damages to the insured vehicle caused by accidents, theft, fire, or vandalism.

• Bodily Injuries: It covers medical expenses for both the driver and passengers of the insured vehicle.

• Temporary Car: Some comprehensive insurance policies provide a temporary replacement vehicle while repairs are being made to the insured car.

• Third-Party Coverage: Like third-party insurance, it also covers damages and injuries to third parties involved in an accident.

Comprehensive insurance is particularly useful for individuals with high-value vehicles or those who want to protect their investment against unforeseen events.

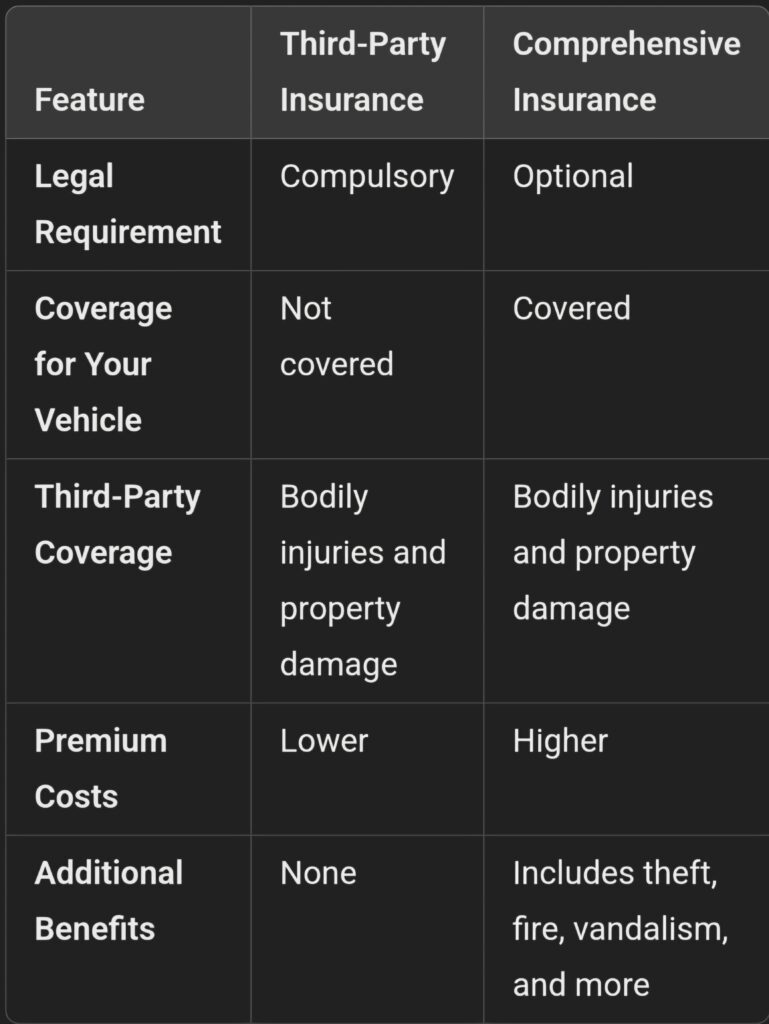

Differences Between Third-Party and Comprehensive Insurance

The choice between third-party and comprehensive insurance often depends on the vehicle owner’s needs, budget, and level of risk tolerance.

Benefits of Comprehensive Insurance

Though optional, comprehensive insurance offers numerous advantages that make it a worthwhile investment:

• Financial Protection: It eliminates the financial burden of repairing your vehicle after an accident.

• Peace of Mind: Knowing that your vehicle, injuries, and liabilities are covered provides significant reassurance.

• Convenience: Policies that include temporary replacement vehicles ensure minimal disruption to your routine.

• Value Retention: Comprehensive insurance can help maintain the value of your car by covering costly repairs.

Why Comprehensive Insurance Is Important in Nigeria

Nigeria’s roads are notorious for their poor conditions, heavy traffic, and the prevalence of uninsured drivers. These factors increase the likelihood of accidents, making comprehensive insurance a valuable safety net. Without comprehensive insurance, car owners bear the full cost of repairing their vehicles after an accident, which can be financially crippling.

Moreover, comprehensive insurance is especially beneficial for those living in areas with high crime rates or frequent cases of vehicle theft. The policy ensures that the vehicle owner is not left stranded financially in the event of theft or damage.

Despite its importance, many Nigerians view car insurance as an unnecessary expense. This misconception often stems from a lack of awareness about the benefits of insurance policies. Some drivers also opt for fake insurance certificates to save money, which leaves them vulnerable in the event of an accident.

Additionally, there is a lack of trust in insurance companies due to delays in claim processing and disputes over coverage. To address these concerns, regulatory bodies like the National Insurance Commission (NAICOM) have implemented reforms to improve transparency and efficiency in the insurance sector.

How to Choose the Right Insurance Policy

Choosing the right insurance policy depends on your specific needs and financial capacity. Here are some tips to guide your decision:

• Assess Your Risks: Consider factors like the age and value of your vehicle, your driving habits, and the areas you frequently travel.

• Compare Policies: Research multiple insurance providers to find the best coverage and premium rates.

• Read the Fine Print: Understand the terms and conditions of your policy to avoid surprises during claims.

• Verify Authenticity: Ensure that your insurer is licensed by NAICOM to avoid falling victim to fake insurance schemes.

Conclusion

Car insurance is not just a legal requirement in Nigeria; it is a vital tool for protecting road users from financial and emotional distress. While third-party motor insurance provides the minimum coverage needed to drive legally, comprehensive insurance offers broader protection that benefits both the insured and third parties. By understanding the differences and benefits of these policies, Nigerian car owners can make informed decisions to safeguard themselves and others on the road.

As road safety continues to be a significant concern in Nigeria, adhering to insurance regulations and choosing the right policy are critical steps toward reducing the impact of road accidents. Whether you opt for basic third-party coverage or invest in a comprehensive plan, car insurance is an essential part of responsible vehicle ownership.