Car theft is a common challenge in Nigeria, and one recent incident serves as a stark reminder of this harsh reality. A friend recently lost his car during a wedding ceremony. He had parked and joined the festivities, only to discover upon returning that his car was gone. The car, barely a year old, was stolen. In the chaos and shock of the situation, the first question many asked was whether the car had a tracker. Unfortunately, it did not.

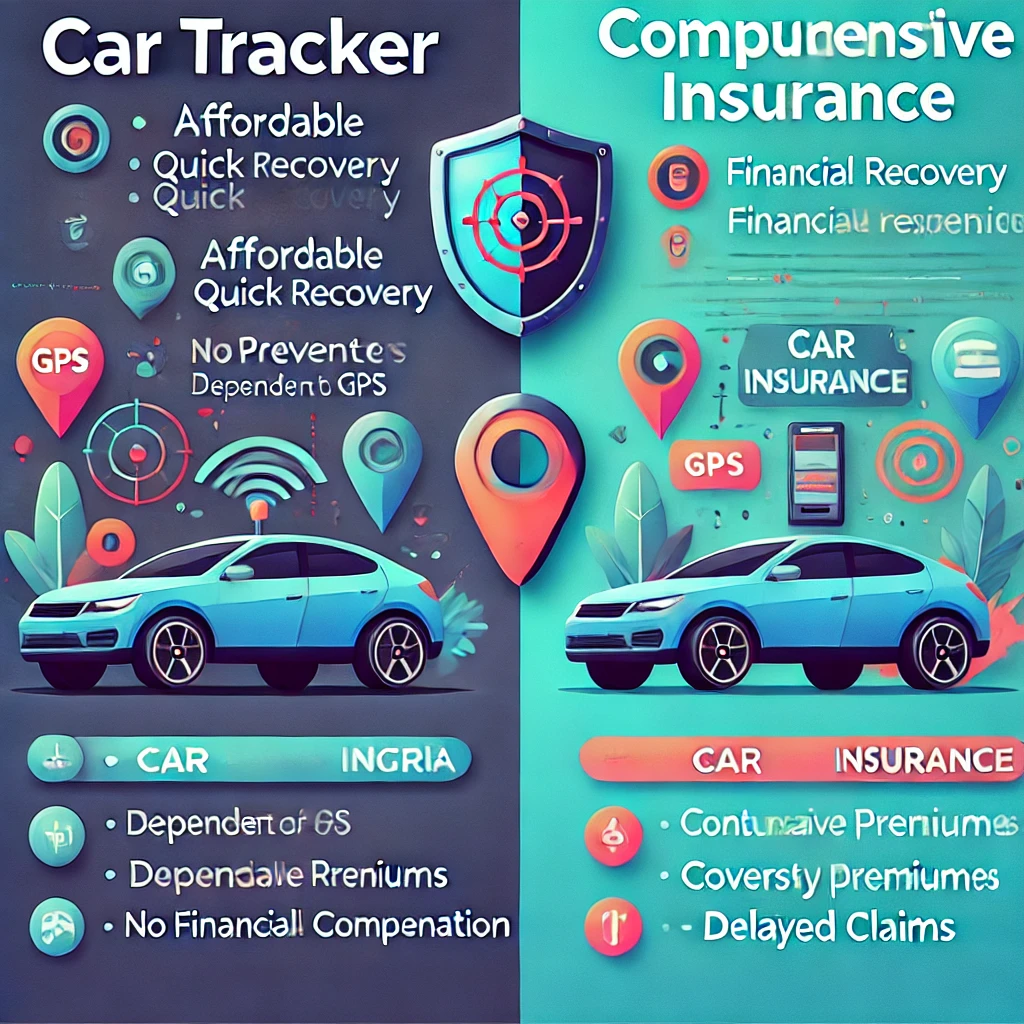

While this might seem like the logical question, one glaring omission stood out—nobody asked about comprehensive insurance. This reveals a preference deeply rooted in the Nigerian car owner’s mindset: car trackers are often prioritized over comprehensive insurance. But is this a smart trade-off? Let’s explore the key differences between these two options and evaluate their merits.

Understanding Car Trackers

A car tracker is a device installed in a vehicle to monitor its location in real time. By using GPS technology, a tracker enables vehicle owners and sometimes security operatives to locate and recover a stolen car. In a country like Nigeria, where car theft is alarmingly common, this technology has gained widespread popularity.

Benefits of a Car Tracker

• Quick Recovery of Stolen Vehicles: A tracker significantly increases the chances of recovering a stolen car. Law enforcement agencies can use the tracker’s data to pinpoint the car’s location.

• Cost-Effective: Compared to the upfront and ongoing costs of comprehensive insurance, a tracker is relatively affordable. Once installed, the annual or monthly subscription fees are minimal.

• Peace of Mind: Knowing that you can trace your car in the event of theft provides a sense of security for many vehicle owners.

• Integration with Anti-Theft Measures: Modern car trackers often come with features such as remote engine immobilization, allowing the car owner to disable the car remotely.

Limitations of a Car Tracker

• Dependency on Technology: Car trackers rely on GPS signals and mobile networks. In areas with poor connectivity or if the device is tampered with, the system may fail.

• Not Foolproof: Sophisticated thieves can disable trackers or use signal jammers to prevent detection.

• No Financial Compensation: Even if a car is recovered, it may have sustained damage or lost valuable items. A tracker doesn’t provide monetary coverage for such losses.

What is Comprehensive Insurance?

Comprehensive insurance is a policy that covers a wide range of risks, including theft, fire, accidental damage, and even natural disasters. Unlike a third-party policy that covers only damages caused to others, comprehensive insurance provides protection for the car owner’s vehicle as well.

Benefits of Comprehensive Insurance

• Financial Compensation: If your car is stolen or damaged, the insurance company compensates you based on the value of the car or the repair costs.

• Broad Coverage: Beyond theft, comprehensive insurance covers events such as accidents, vandalism, and even floods—common risks in Nigeria.

• Legal Compliance: Comprehensive insurance often meets and exceeds the basic legal requirements for vehicle coverage in Nigeria.

• Third-Party Protection: Many comprehensive policies also cover damages to third-party vehicles or property, reducing the risk of out-of-pocket expenses after an accident.

Limitations of Comprehensive Insurance

• Cost: Comprehensive insurance is significantly more expensive than a tracker. Premiums are calculated based on the car’s value, the owner’s profile, and other risk factors.

• Delayed Compensation: The claims process can be lengthy and sometimes frustrating, requiring documentation and verification.

• Exclusions: Some policies come with exclusions, such as not covering theft if the owner left the keys in the car or failed to install basic anti-theft measures.

Comparing Car Trackers and Comprehensive Insurance

1. Purpose

• A car tracker is primarily a preventive measure, designed to help recover a stolen vehicle. It does not mitigate financial loss.

• Comprehensive insurance, on the other hand, focuses on financial protection, ensuring the car owner is compensated in the event of theft, damage, or other risks.

2. Cost

• Trackers are a one-time purchase with minimal recurring fees, making them affordable for most Nigerians.

• Comprehensive insurance requires annual premiums, which can be significant, particularly for high-value cars.

3. Effectiveness Against Theft

• Trackers improve the chances of recovery but are not foolproof. If thieves disable the tracker, the car may be lost forever.

• Comprehensive insurance doesn’t prevent theft but ensures financial recovery, providing a safety net regardless of whether the car is recovered.

4. Broader Protection

• Trackers offer no protection against risks like accidents or fire.

• Comprehensive insurance provides all-around protection, covering a wide range of risks beyond just theft.

The Nigerian Context: Why Trackers are Preferred

In Nigeria, the preference for car trackers over comprehensive insurance can be attributed to several factors:

• Affordability: Most Nigerians find the cost of comprehensive insurance prohibitive, especially when compared to the relatively low cost of installing a tracker.

• Distrust in Insurance Companies: Many people distrust insurance providers, fearing that claims will be denied or delayed unnecessarily.

• Immediate Benefits: The tangible, immediate benefit of a tracker—a higher likelihood of recovering a stolen vehicle—appeals more to car owners than the long-term promise of financial compensation.

Which is Better?

Choosing between a car tracker and comprehensive insurance ultimately depends on the car owner’s priorities and budget.

• If your primary concern is recovering your car in the event of theft, a tracker is the better choice. It is affordable and provides a practical solution to Nigeria’s high car theft rates.

• If you can afford it, comprehensive insurance is the superior option. It offers broader protection, financial compensation, and peace of mind, ensuring you are covered for a wide range of potential losses.

For those who can manage both, installing a tracker and purchasing comprehensive insurance offers the best of both worlds—enhanced recovery chances and financial protection

Conclusion

While car trackers and comprehensive insurance serve different purposes, they are both valuable tools for mitigating the risks associated with car ownership. In a high-theft environment like Nigeria, combining both options is the most effective strategy. However, for those forced to choose, understanding the trade-offs between them is essential. A tracker may help recover your car, but comprehensive insurance ensures you’re not left financially stranded, regardless of the outcome.